SPEAKING ENGAGEMENTS

Have Paul Dion speak at your upcoming event

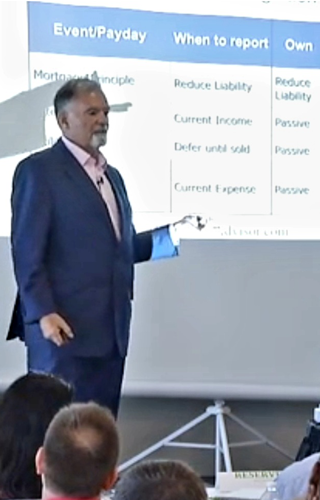

Paul Dion CPA will come to your event (or present virtually!) and speak with real estate agents, brokers, and investors to help them discover how to save thousands of tax dollars every year.

They will leave with eye-opening tax tips and a free copy of Paul’s book “The Ten Most Expensive Tax Mistakes that cost Real Estate Agents Thousands” or the “Real Estate Investor Tax Guide.”

Paul operates a New England Regional CPA practice specializing in proactive tax planning for business owners.

He has been planning and preparing tax returns for small businesses, real estate agents, and real estate investors for more than 25 years. As a tax professional specializing in helping small businesses keep more of their hard-earned money, he has helped businesses recover $3,000 to $7,000 or more in overpaid taxes in a single year and has saved some businesses as much as $25,000 per year in excess tax dollars.

Call 508-853-3292 or email info@smarttaxadvisor.com for information.

Paul is a regular contributor to Real Estate Talk Boston at www.boston.com/retb as a power player and provides regular articles to the New England Real Estate Journal which can be found at www.Nerej.com.

He is enthusiastic about the challenge of helping clients manage their business financial matters with tax planning services and beyond. In addition to proactive tax preparation and planning, Paul continues to identify financial resources he can provide or recommend to enhance the wealth of his clients and has the experience and business insight to help you save tax dollars – legally!

Download our: Realtor Presentation Flyer Investor Presentation Flyer